The Country Music and Rockabilly Hall of Famer, Conway Twitty was known for his 44 number–one singles and his ability to cross over into the genres of Rock, Pop and Rhythm and Blues.

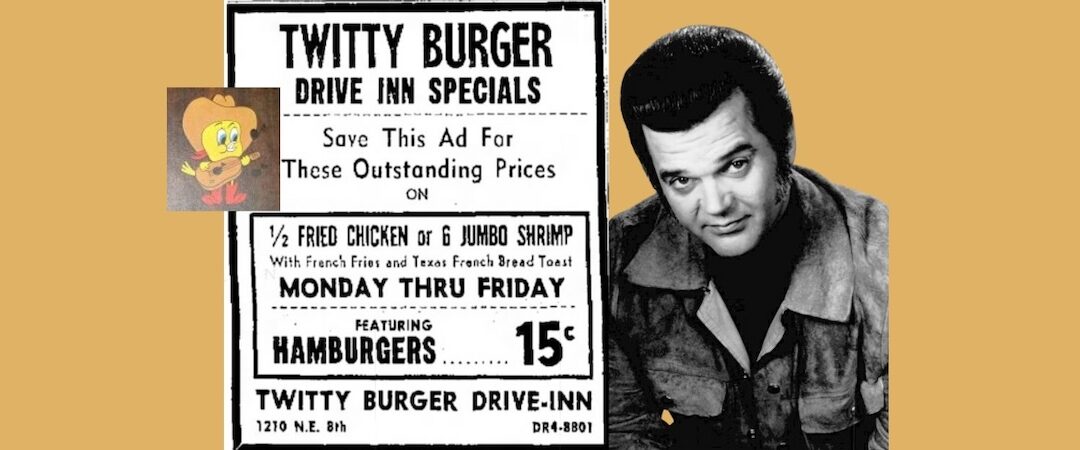

In addition to his vocal success, Twitty aspired to become a restaurant owner. Soon some of Country’s favorites, including Merle Haggard and Sonny James, were quickly convinced to add money to Twitty’s own $100,000 investment to aid him in opening the doors of Twitty Burger in 1969.

Artists, such as Dolly Parton, Jim Ed Brown, Dottie West, Don Gibson and Porter Wagner performed their County hits at the Twitty Burger Grand Opening.

In the early to mid 1970s Twitty was celebrated numerous times, receiving a Grammy Award, several Academy of Country Music Awards and four Country Music Association Awards for his beloved collaborations with Loretta Lynn. He would go on in later years to receive many more awards, such as a 1999 Grammy Hall of Fame Award for his unforgettable ballad, “Hello Darlin’.”

Just as his music was top–notch, Twitty had the ambition to create the best burger around. For the large appetite the Papa Twitty Burger was offered. For the medium appetite it was the Mama Twitty, and for a small appetite there was the Itty Bitty Twitty. The Twitty Burger itself consists of a patty of 100 percent pure ground beef. The burger was in a league of its own as far as recipes were concerned.

The Conway Twitty Burger Recipe began with a four-ounce ground sirloin patty cooked as desired. Next a pineapple ring was dipped in crushed graham cracker crumbs and deep-fried. A five-inch hamburger bun was smeared with mayonnaise on both interior facings, and the pineapple ring, the burger and two slices of crisp bacon were inserted. Finally, the burger was embellished with the customer’s condiment preferences and served hot and ready to enjoy.

Although Twitty had received tens of thousands of dollars from 75 investors to launch what he thought was going to be a successful business, it unfortunately did not have the expected result. Poor management and Twitty’s lack of business sense did not serve him well. The restaurant closed in May of 1971, and in 1973-1974 Twitty decided to pay the investors back from his own pocket. The IRS was very unhappy when Twitty wrote the repayment of approximately $96,000 off his taxes. Twitty was sued in Federal court for writing off the reimbursement. The IRS asserted that the loss should be written off of Twitty Burger’s taxes, and because Twitty Burger no longer existed, the singer had no right to deduct the repayment from his personal taxes.

“I’m 99 percent entertainer,” Twitty testified in his 1892 trial. “That’s just about all I

know. The name Conway Twitty and the image that I work so hard for since 1955 and ’56 is the foundation that I, my family and the 30-some-odd people that work for me stand on. They depend on it, and they can depend on it.”

Twitty’s lawyer suggested to the judge that Twitty could easily make $100,000 in the first few minutes of a concert and implied that the IRS was wasting everyone’s time and especially the time of his legendary client. The court agreed and presiding Judge Irwin wrote the opinion in favor of Twitty.

“In making these payments the petitioner was furthering his business as a country music artist and protecting his business reputation for integrity,” the court decided. “The mere fact that they were voluntary does not deprive them of their character as ordinary and necessary business expenses. We hold that the payments in issue are deductible as business expenses.”

The landmark case is studied in law schools and among recording artists to this day. However, the most memorable part of the verdict was the original song by the presiding judge contained in the footnotes of the final order in the case, the lyrics of which are printed on this page.

“Ode to Conway Twitty”

Twitty Burger went belly up

But Conway remained true

He repaid his investors, one and all

It was the moral thing to do.

His fans would not have liked it

It could have hurt his fame

Had any investors sued him

Like Merle Haggard or Sonny James.

When it was time to file taxes

Conway thought what he would do

Was deduct those payments as a business expense

Under section one-sixty-two.

In order to allow these deductions

Goes the argument of the Commissioner

The payments must be ordinary and necessary

To a business of the petitioner.

Had Conway not repaid the investors

His career would have been under cloud,

Under the unique facts of this case

Held: The deductions are allowed.

By Sasha Kay Dunavant, Country Reunion Magazine